Pocket Option Demo: Strategies for Working with It

Pocket Option Demo for Beginners

Why is Pocket Option demo – so important for beginners? Here are the reasons for its usefulness:

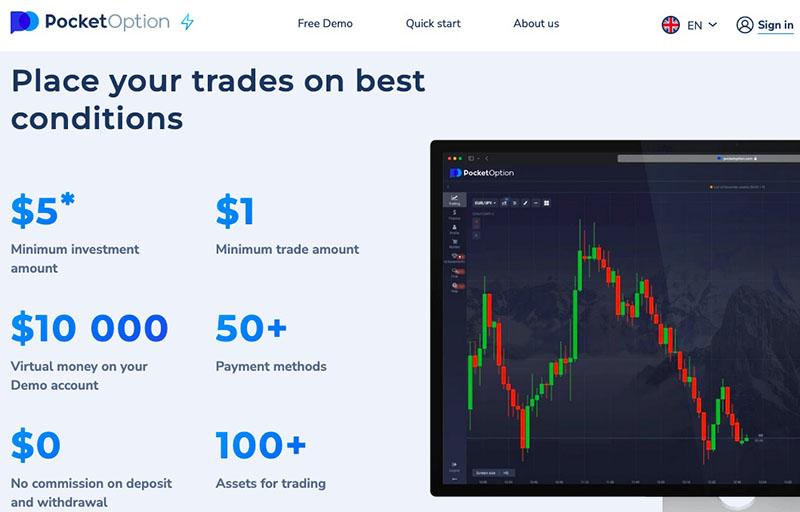

- A demo account gives you the opportunity to familiarize yourself with the functionality of the Pocket Option – https://revieweek.com/review/pocketoption/ platform without the risk of losing real funds.

- Trading on the financial market is associated with risk. A demo account allows beginners to learn and practice without the fear of losing real money. It is an ideal “sandbox” for experiments.

- Before applying any strategy (30 minutes, 15 minutes ) on the real market, you can test it on a demo account. This will help you understand how effective the chosen tactic is and whether it is worth using.

- Trading on financial markets requires not only knowledge and skills, but also psychological stability. With the help of a demo you can learn to control your emotions and make well-considered decisions.

Pocket Option Demo for Professionals

Even for professionals, Pocket Option demo can provide benefits:

- Even experienced traders look for new strategies or modify existing ones from time to time. Demo is a safe environment to test new ideas without the risk of losing capital.

- The market is constantly changing and brokers regularly update their platforms by adding new tools. A demo account allows you to quickly familiarize yourself with them without risk.

- Even for experienced traders, maintaining emotional balance in market conditions is key to success. A demo account can be a place for psychological “training”.

- If a trader works in a team or has assistants, a demo account can be an ideal tool for training them.

- Before applying a new algorithm or technical indicator in real conditions, you can test its effectiveness on a demo.

Demo Pocket Option: Strategies

- Pin Bar Strategy

Pin-bar is a candlestick configuration that has a long tail and a short body. It often indicates a possible market reversal. When a pin-bar is formed after a long trend, it can signal its exhaustion. The most important part of a pin bar is its tail, which shows the market’s refusal to move further in a certain direction.

Advantages:

- Clearly visible on the chart.

- Often indicates exhaustion of the current trend.

- Provides a clear entry point into the market.

- Relatively low risk, as a stop loss can be placed near the tail of the pin bar.

- Allows you to determine the potential risk/reward ratio.

- Double Bottom/Top Strategy

Double bottoms and double tops are classic market reversal patterns. A double bottom is formed after a long downtrend and looks like the letter “W”, while a double top is formed after an uptrend and resembles the letter “M”. These patterns signal a possible change in trend direction.

Advantages:

- Often signal a reversal of a long-term trend.

- Provide clear levels for placing stop losses and take profits.

- Combine well with other indicators to refine the signal.

- Provide insight into the possible strength of the next trend.

- Easily identified even by newcomers to the market.

- Moving averages strategy

Moving averages show the average price of an asset over a certain period of time. When a short moving average (e.g. 50 periods) crosses a long moving average (e.g. 200 periods) from bottom to top, this is considered a bullish signal, and vice versa for a bearish signal.

Advantages:

- Easy to set up on any trading platform.

- Helps to identify the main trend of the market.

- Can be used to determine support and resistance levels.

- Combines well with other technical indicators.

- Suitable for any time frame of the chart.

- RSI (Relative Strength Index) strategy

RSI is a technical indicator that measures the speed and change of price movements. It ranges from 0 to 100 and helps to determine if the market is overbought or oversold. Overbought levels are usually above 70, while oversold levels are below 30.

Benefits:

- Easy to interpret and use even for beginners.

- Helps to identify potential market reversals at overbought and oversold levels.

- Effective on different timeframes.

- Combines perfectly with other indicators and methods of analysis.

- Allows you to avoid premature entry into the market, waiting for confirmation of the signal.

- Bollinger Bands strategy

Bollinger Bands consist of three lines: a moving average and two standard deviations above and below it. When the price of an asset approaches the upper band, it may indicate overbought, and when it approaches the lower band, it may indicate oversold.

Advantages:

- Easy to set up and interpret.

- Helps to identify market volatility.

- Provides clear support and resistance levels.

- Can be used to identify “compression”, which often precedes major price movements.

- Combines perfectly with other indicators such as RSI or MACD.